Welcome to PCI Consulting Services. guardlii specializes in guiding retail organizations through the intricacies of PCI DSS, the security standards essential for safeguarding cardholder data and secure payment processing. Our team of experienced consultants can help establish robust security measures, identify vulnerabilities, and reduce risks, ensuring compliance with regulatory requirements.

What is PCI DSS Compliance?

PCI DSS is a set of security standards designed to safeguard cardholder data and ensure secure payment processing. PCI DSS is mandatory for all organizations that handle, process or store payment card information. Our team of experienced consultants is dedicated to helping organizations navigate the complexities of PCI DSS. We establish robust security measures to identify vulnerabilities, reduce risks and maintain a secure environment for payment card data while meeting regulatory requirements.

As we transition to PCI DSS version 4.0 from 3.2.1, expect a more flexible approach to security controls. This empowers businesses to tailor security measures to their risk profiles while emphasizing continuous risk assessment. Our PCI DSS Compliance Consulting Services will support your smooth adaptation to version 4.0, addressing evolving security challenges posed by new technologies like mobile transactions and cloud computing. Trust us to uphold the highest data security standards.

1. PCI DSS Readiness Assessment and Scope Identification:

For businesses seeking to achieve Payment Card Industry Data Security Standard (PCI DSS) compliance, our comprehensive assessment is the crucial first step on this journey. Our expert team of consultants is well-versed in the intricacies of PCI DSS requirements and will conduct a thorough evaluation of the client's existing processes, systems, and policies. Through this assessment, we identify the scope of the client's cardholder data environment (CDE), determining which areas fall under PCI DSS compliance obligations. By accurately defining the scope, our clients can avoid unnecessary compliance efforts and focus their resources on securing the critical aspects of their payment card infrastructure. Our personalized approach ensures that our recommendations are tailored to the unique needs of each client, helping them build a solid foundation for achieving and maintaining PCI DSS compliance while instilling confidence in their customers and business partners. With our expertise and commitment to excellence, we empower our clients to navigate the complexities of PCI DSS and establish a secure and compliant environment for processing payment card data.

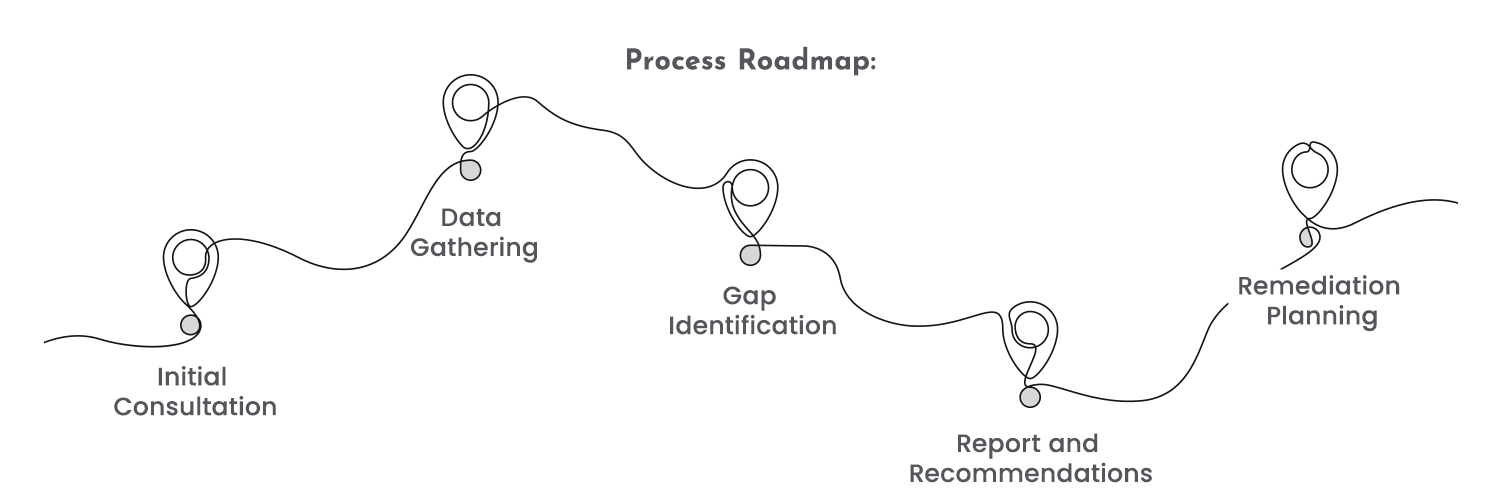

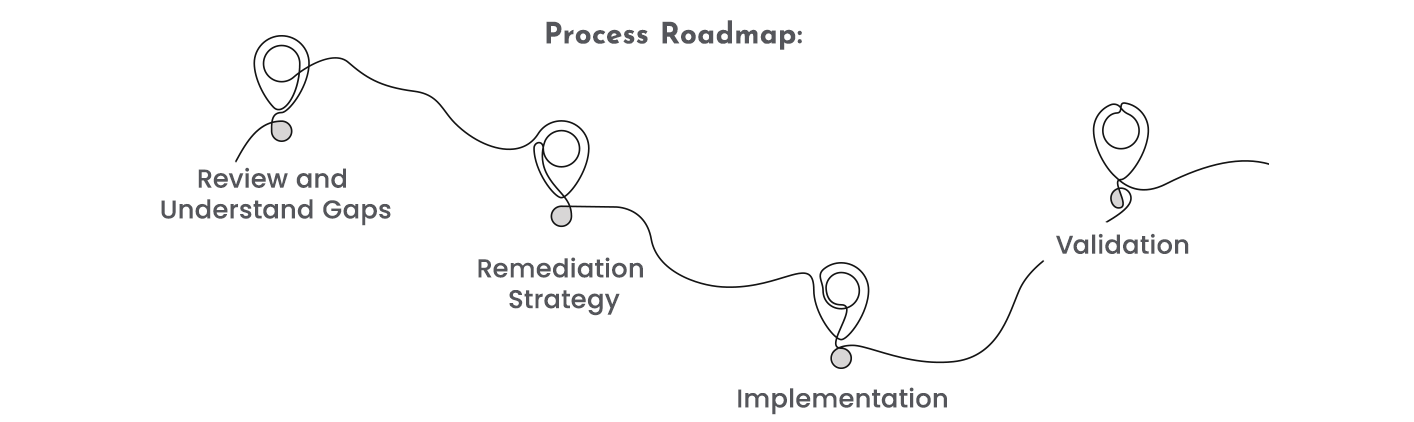

2. Gap Analysis and Remediation:

During the Gap Analysis, our experienced consultants will compare the client's existing security controls, processes, and practices against the requirements outlined in the PCI DSS standard. This analysis allows us to identify any gaps, vulnerabilities or areas of non-compliance that need to be addressed to achieve full PCI DSS compliance.

Following the Gap Analysis, we work closely with the client to develop a detailed remediation plan. This plan outlines the specific steps and actions needed to address the identified gaps and bring the client's organization into compliance with the PCI DSS standard. Our team of experts assists the client throughout the remediation process, providing guidance, best practices, and practical solutions to ensure a smooth and efficient path to compliance.

Throughout the Gap Analysis and Remediation service, we prioritize open communication and collaboration with our clients, tailoring our approach to their unique business needs and challenges. We understand that achieving and maintaining PCI DSS compliance is an ongoing effort, and our goal is to empower our clients to establish robust security measures that protect sensitive cardholder data, build trust with their customers, and strengthen their overall security posture.

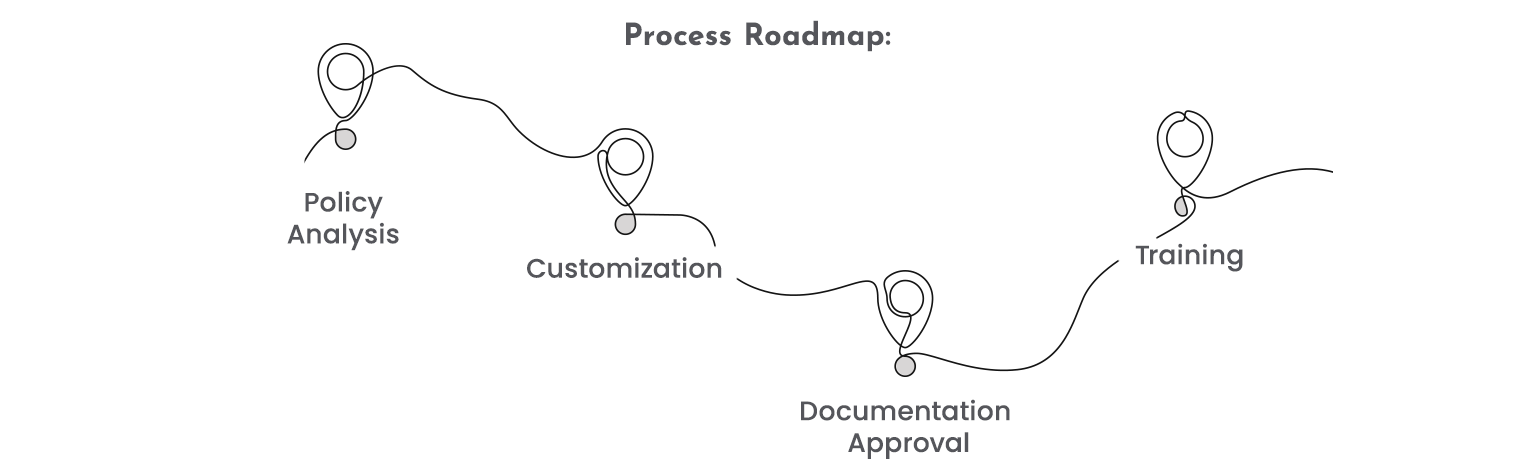

3. Policy and Procedure Development:

Our consulting firm offers a specialized Policy and Procedure Review and Update service, focusing on aligning our clients' existing policies and procedures with the stringent requirements of the Payment Card Industry Data Security Standard (PCI DSS).

As part of this service, our expert team conducts a comprehensive review of the client's current policies and procedures related to information security, payment processing, and data handling. We meticulously compare these policies against the specific requirements outlined in the PCI DSS standard.

Through this thorough examination, we identify any gaps, inconsistencies, or areas of non-compliance with the PCI DSS requirements. Our team then provides clear and actionable recommendations to update the policies and procedures, ensuring they fully align with the strict security measures mandated by PCI DSS. Our goal is to create a cohesive and robust information security framework that not only meets the PCI DSS compliance requirements but also fosters a culture of security awareness throughout the organization.

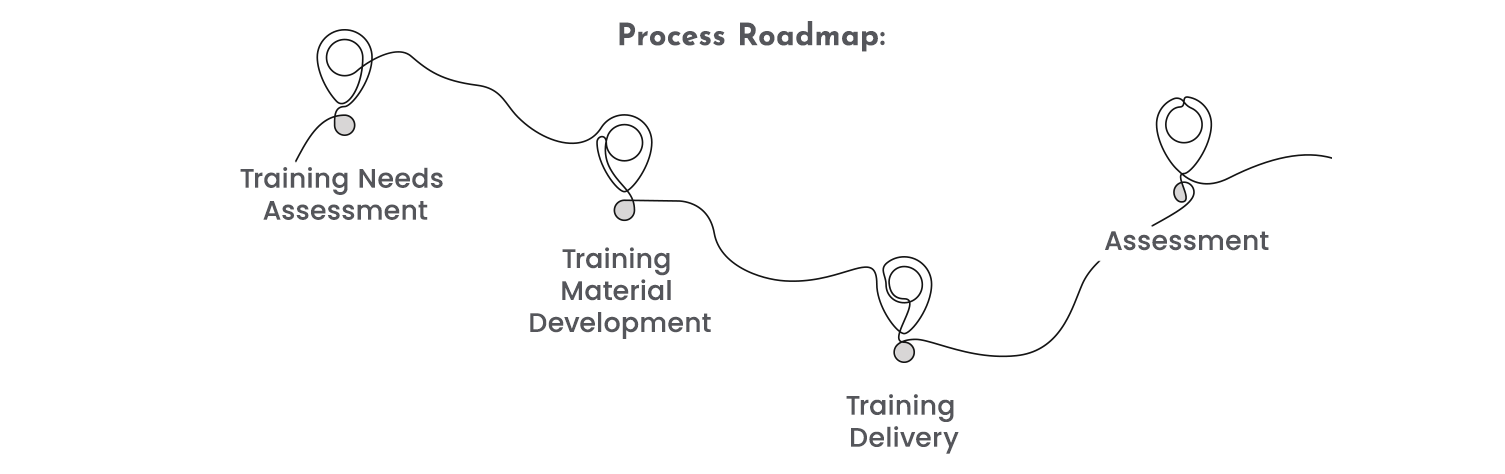

4. Security Awareness Training:

Employees play a critical role in maintaining PCI DSS compliance. Our Security Awareness Training equips your staff with the knowledge and best practices necessary to identify and respond to potential security risks effectively. Through interactive training sessions, workshops, and informative materials, we empower your workforce to become a vital component of your security posture.

Our training program covers essential security topics, such as password management, phishing awareness, secure handling of payment card data, physical security measures, and best practices for secure remote access. We also address emerging security threats and the importance of reporting any suspicious activities promptly.

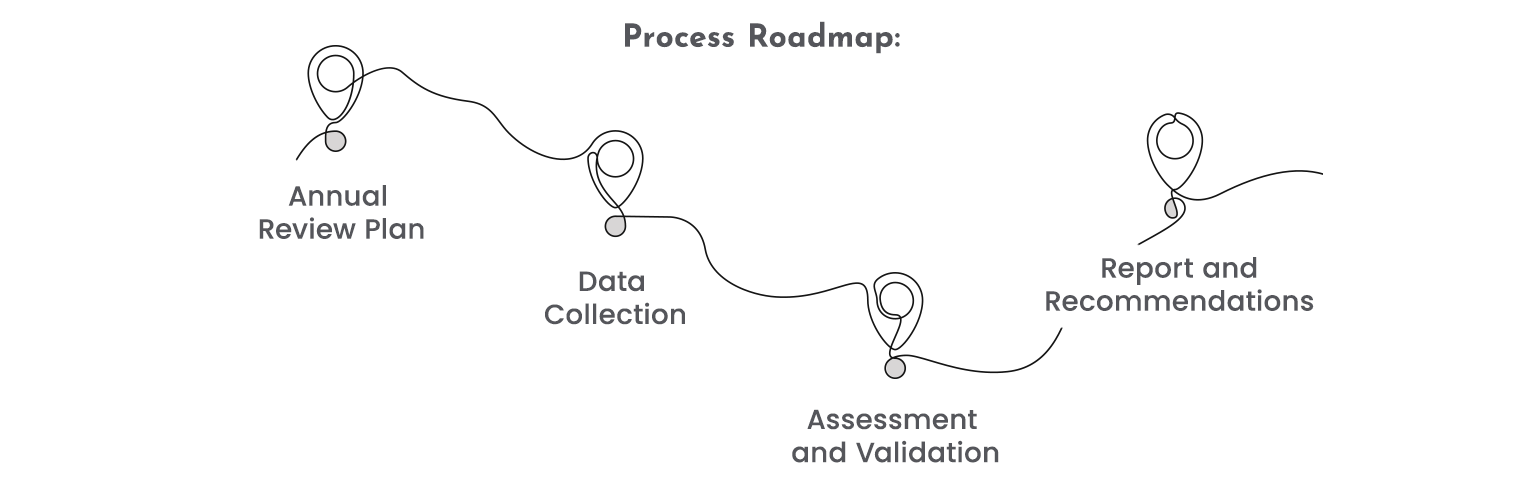

5. Annual PCI DSS Compliance Review:

PCI DSS compliance is an ongoing process, and businesses must maintain their security measures to sustain compliance. Our Annual Compliance Review service provides a valuable Continuous Support with Compliance Review Service, offering ongoing regular assessments to ensure your organization continuously meets PCI DSS standards. Through this service, we help you identify and address any emerging risks or changes in your business environment that could impact compliance.

Our consultants will work closely with your internal teams, collaborating on any necessary updates to policies, procedures, and security controls. We assist in implementing security measures and best practices to address any identified gaps and improve overall security posture.